How It Works: Thankyou Payroll is a software provider and PAYE Intermediary

As an IRD accredited PAYE Intermediary, we make it easy for you to process your payroll all in one place while handling all of the IRD filing and payments on your behalf. Quick, simple, and compliant. Tick!

What you do

Sign up & set up your employees

You only need to do this once and we’ll send onboarding support straight to your inbox every step of the way.

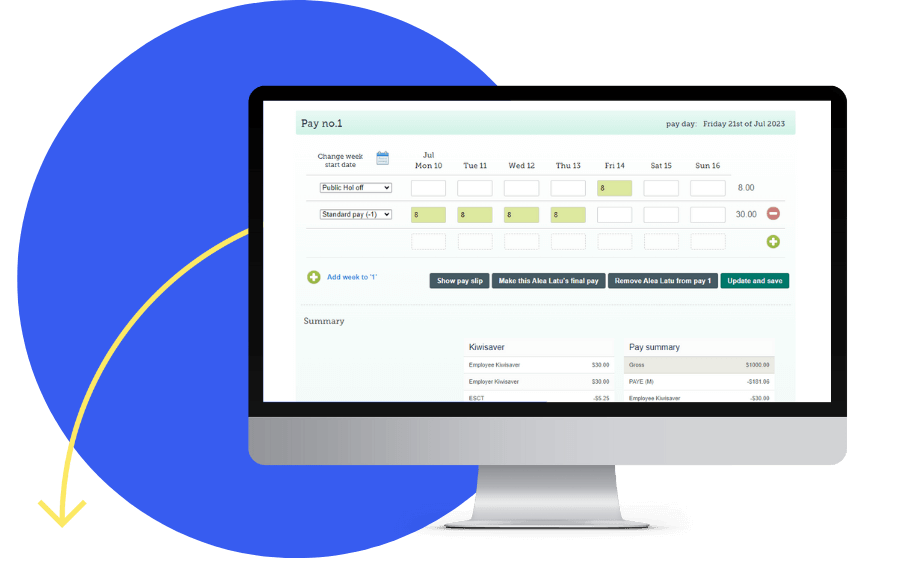

Enter employee timesheets

Thankyou Payroll offers a number of pay shortcuts to make timesheets a quick tick.

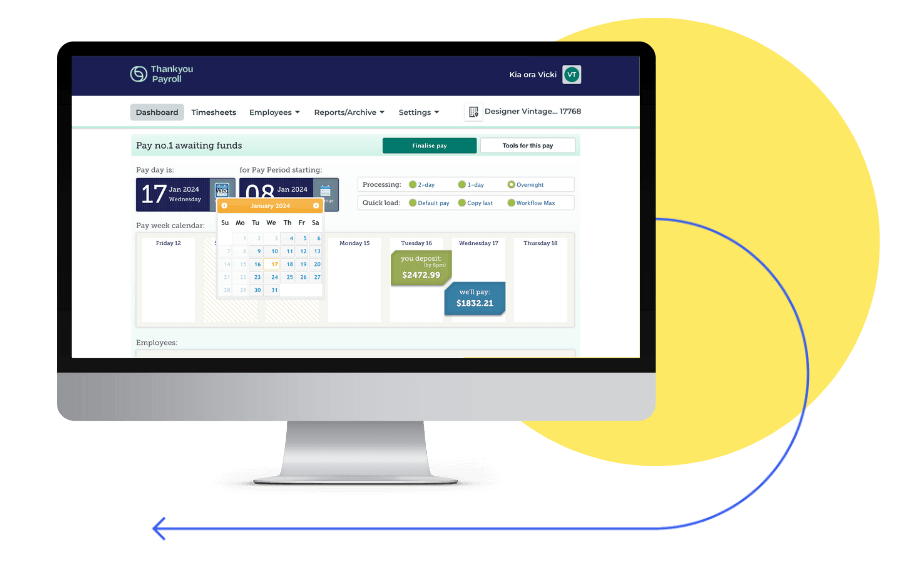

Choose a payday

Select a payday that works for you. If you’re in a hurry you can run your pay overnight or on the same day.

Make a transfer

Transfer your money before your payday. If you use direct debit, we do this for you!

You're off the hook!

We take it from here so that you can get back to building NZ’s next breakthrough business.

What we do

Run the calculations

Once you’ve confirmed your pay, we run the numbers; dividing up your employee payments, Kiwisaver, PAYE, and other taxes.

Pay your employees

Process your payroll in just one lump sum. We’ll then distribute correctly to IRD and your employees.

Send your payslips

We’ll send your employees’ payslips straight to their inbox every time you run a pay. Happy employees, happy employer.

Payday filing

No more nitty gritty paperwork – we interact with IRD on your behalf helping you to save time, stay compliant and avoid unwanted fines.

Kiwisaver, PAYE, and other payments to IRD

We help you to fulfil your responsibilities as an employer by correctly distributing your Kiwisaver, PAYE, and other taxes on your behalf.

But wait, there’s more

Aside from our processing services, our payroll software offers numerous features to enhance your experience with us. From time-saving shortcuts, to Xero Integration, to our Employee App – there’s no shortage of features to explore.

How payroll works in New Zealand

New to the payroll process? Our Guide to NZ Payroll is the perfect starter kit and breaks down all the payroll basics you need to know in the beginning.

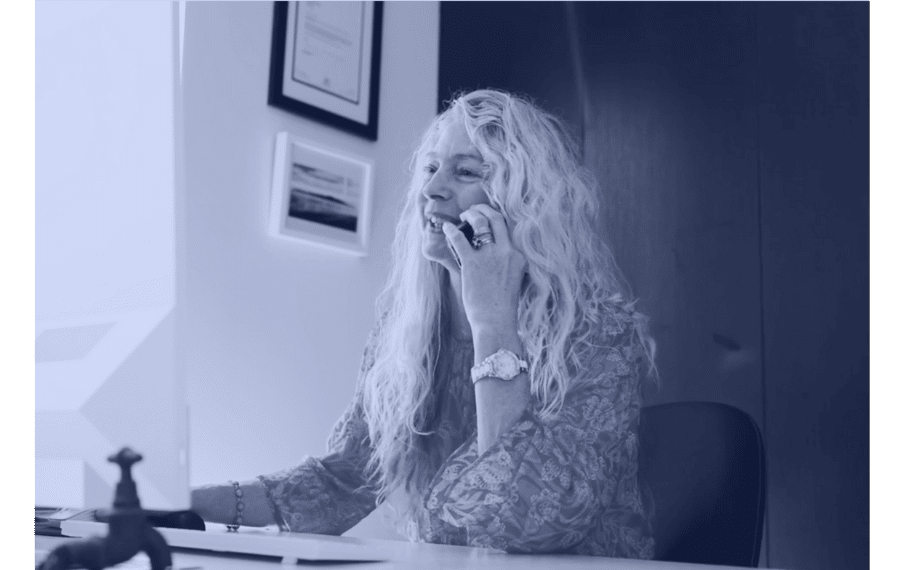

Payroll expertise with a big dollop of compassion

Payroll is never as straightforward as it seems which is why we don’t hold back when it comes to offering you the support you need. Our down-to-earth payroll experts are with you every step of the way.

Onboarding guidance

First time employer? Switching providers? No problem. Our payroll onboarding process is smooth, slick, and personalised – with people on hand to help you along the way.

Real time payroll support

Payroll doesn’t wait for anyone and neither should you. Our NZ-based experts are always on hand 8.00am-5.30pm, Monday-Friday. Oh, and our average hold time is less than 2 minutes!

Important reminders

Payroll can be hard to stay on top of, especially with public holidays & legislation changes thrown in the mix. To help you stay compliant, we send regular reminders straight to your inbox.

How does Thankyou Payroll fit into your plan?

Whether you’re a business owner, accountant, charity, or employee, Thankyou Payroll has something to suit everyone.

Small businesses

97% of NZ’s businesses are small and that’s a pretty big deal if you ask us.

We’ve spent over a decade getting to know the nitty gritty of payroll to develop a software and service designed to reduce the strain of complex legislation for small business owners like you.

Accountants and Bookkeepers

Recommending products and services as an accountant or bookkeeper can carry reputational risks for your business and that’s something we take seriously.

We’re committed to helping you build your customer base through delivering an exceptional service for you and your clients.

Charities

Just like businesses, charities deserve good payroll software and we don’t want cost to be a barrier. Your money belongs in the communities you are serving.

That’s why we offer free payroll services to all registered charities in Aotearoa New Zealand – no matter the plan you choose.

Employees

Thankyou Payroll isn’t just designed for the business owners – it’s for the business as a whole.

Our user-friendly Employee App allows employees to view their payslips and leave balances anytime, anywhere. Available from the Apple App Store and Google Play Store.

Got a question about our payroll process?

We’ve got answers. Browse our FAQs or get in touch with one of our friendly payroll experts.

How much does your payroll support cost?

Nothing! Payroll can be tricky and we don’t want to stand in the way of you getting the help you need which is why our Payroll Support Team will give you same day service completely free of charge.

Do we pay more for your PAYE Intermediary service?

No. We believe this is an essential service for small and medium businesses. This is all included in your monthly price.

Will Thankyou Payroll calculate my payroll for me?

Yes. You’ll just input your employee’s hours and we’ll calculate the rest. You’ll still need to confirm the final figures and ensure your employees are set up correctly to avoid mistakes.

Is your service really free for charities?

Our payroll service is 100% free for charities. Offering a free service to charities means they can invest more money in making good things happen in the communities they are serving.