Irresistible payroll pricing for small businesses

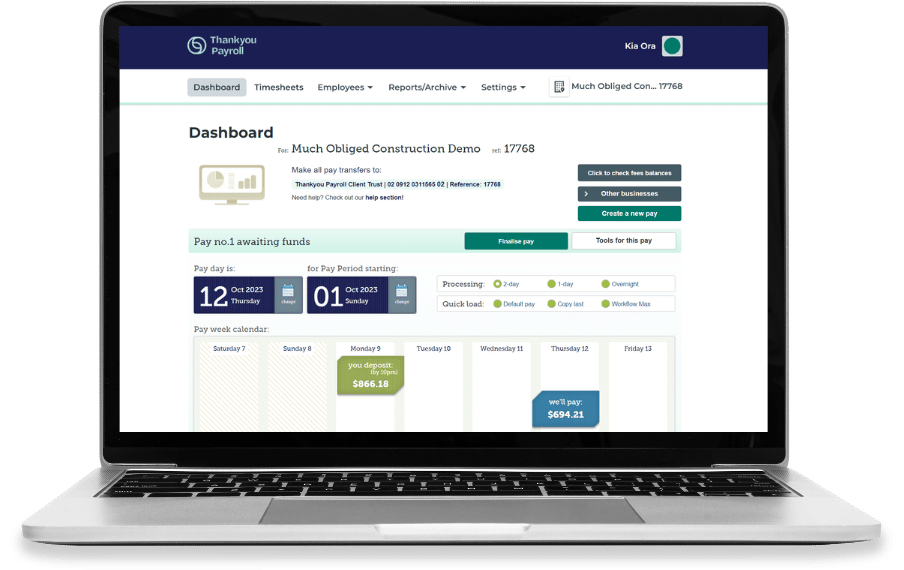

Good payroll software is essential for any small business but it shouldn’t break the bank. Starting at $7 a month, Thankyou Payroll offers the best value payroll pricing in the game – allowing you to invest more in making good things happen.

Payroll plans from just $7 a month

Our payroll plans are entirely flexible. You’re only charged for the number of pays you run in a given month and you can switch plans whenever, at no extra cost.

Fast Payroll Plan

$2 per employee + $6 (standard rate per pay)

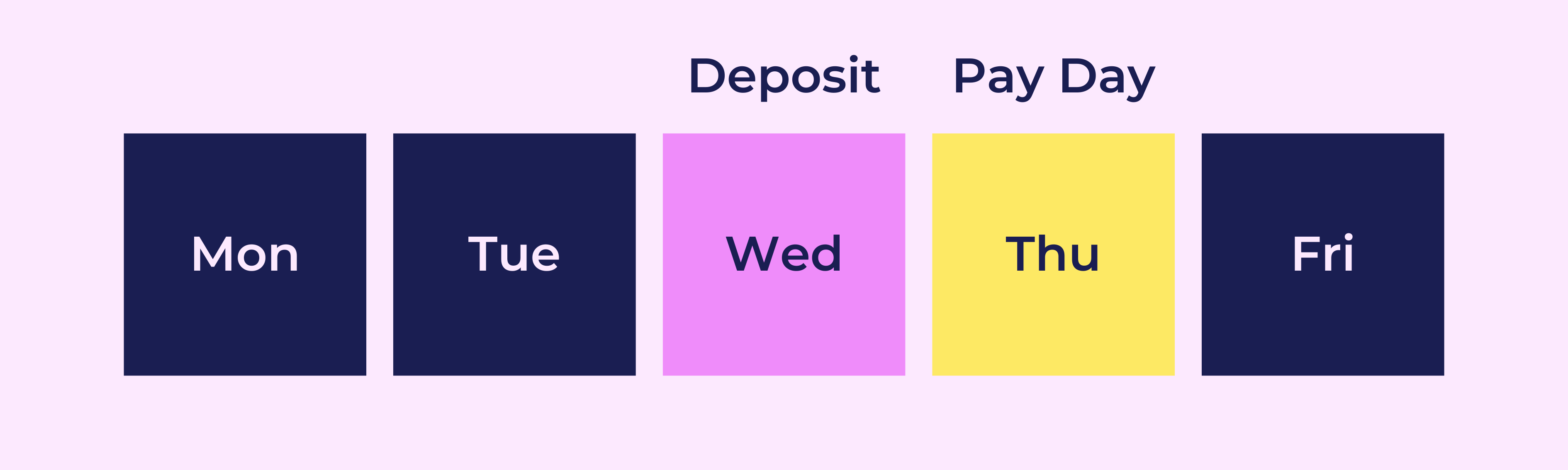

Deposit your payroll funds the day before your pay day if cash flows are your priority.

2 Day Payroll Plan

$1 per employee + $6 (standard rate per pay)

Deposit your payroll funds two full business days before your pay day to keep your costs low.

Save up to $52 a month with our price caps*

Our price caps mean you won’t spend over a certain amount each month, allowing you to effortlessly forecast your business’ cash flows.

| Employees Paid** | Monthly Cap |

| 1-3 | $39 |

| 4-10 | $69 |

| 11-30 | $109 |

| 31-50 | $179 |

| 51+ | $274 |

*Savings made by a business running weekly pays for 10 employees.

**Fees are set based on the number of individual employees paid in a given month. Prices exclude GST.

Calculate your payroll fees in seconds

“Fantastic service. They make payroll very easy and affordable for a small business.”

– Tamara Pawson, Hassle-Free Rentals

You get… everything!

Xero integration

Stay on top of project expenditures and budgets with seamless integration into Xero. Simply categorise your payroll data in our system and pull it all into Xero in just one click.

Automated tax payments & payday filing

No more tax hassles or fines. Our payroll system takes care of payday filing, PAYE, Kiwisaver, and other IRD payments

Employee payments & payslips

Sort your employee payments in one lump sum transfer – we do the rest. Plus, we’ll even send a payslip right to their inbox!

Customisable timesheets

Effortlessly add allowances, pay types, leave and more to your timesheets – uniquely customised to the way your business works.

Pay shortcuts

Designed for time-strapped business owners, our payroll system offers many pay shortcuts so that you don’t have to start from scratch every time you run a pay.

Reporting

Gain insights into your payroll with our comprehensive reporting features. We’ll make your EOFY reporting a breeze!

Employee App

Empower your employees with our user-friendly Employee App where they can view their payslips and leave balances. Available from the Apple App Store and Google Play Store.

Try before you buy

Deciding whether Thankyou Payroll is a good fit for your business isn’t something that can be done in a day. That’s why we won’t charge you a penny for our payroll software until you run your first pay!

Free for charities

Our software and service is 100% free for charities because we don’t want payroll to stand in the way of making good things happen. Your money belongs in the communities you’re serving.

“As a small charitable organisation, their excellent free service means that we can put more of our resources into rescuing and distributing kai to those who need it most.”

– Michelle Rodriguez Ferrere, Gizzy Kai Rescue

Got a question about our payroll pricing?

We’ve got answers. Browse our FAQs or get in touch with one of our friendly payroll experts.

Are there any hidden fees?

No. We’re upfront about the cost so you can plan for your success.

Do we pay more for your PAYE Intermediary service?

No. We believe this is an essential service for small and medium businesses. This is all included in your monthly price.

What if we pay a different number of employees each month?

You’re only billed for the number of individual employees you pay each month. If you pay fewer staff in one month, you’ll pay less.

How can we pay you?

The easiest way to pay Thankyou Payroll is via direct debit. This means you don’t have to think about making payments. Alternatively, you can manually transfer the funds to Thankyou Payroll.