Choosing a PAYE Intermediary

Find out how you can save on resources AND stay compliant with a PAYE Intermediary.

The payroll scene in Aotearoa New Zealand can be tricky to navigate – especially for new business owners.

Faced with limited time and money, the last thing you need on your to-do list is another unfamiliar, somewhat overwhelming, task that will drain these precious resources from you.

The good news? Payroll can be a lot easier if you want it to be. It’s simply a matter of choosing a payroll provider that works for you…

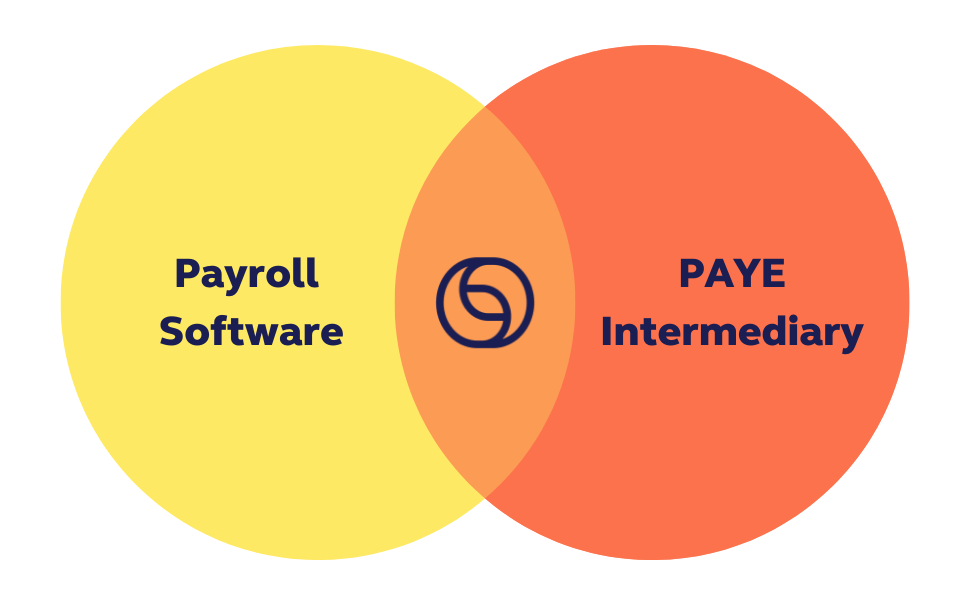

Payroll Software vs PAYE Intermediaries

What many people don’t realise is that payroll software and PAYE (Pay As You Earn) intermediaries are two separate entities.

Payroll Software

Payroll Software is essentially a digital toolbox for business owners to perform their payroll in-house. It will calculate an employee’s pay and leave entitlements based on the hours they have worked – entered by the employer. It will also generate payslips and deposit an employee’s pay into their designated bank account. The rest is up to you.

On its own, payroll software is well suited to employers who want oversight across every step of the payroll process. It grants you full responsibility for employment information submissions, tax payments and payroll queries.

PAYE Intermediaries

A PAYE Intermediary takes your payroll services one step further by engaging with IRD on your behalf and assisting you to fulfil your legal obligations as an employer.

These services include:

- Filing your employee information forms within two working days.

- Paying IRD the deductions made from your employees’ pay each month.

- Resolving queries with IRD.

PAYE Intermediaries can be payroll software providers, accountants or tax agents.

Thankyou Payroll

Thankyou Payroll is an accredited PAYE Intermediary which also provides payroll software; we’re one of only a handful of IRD accredited PAYE Intermediaries in Aotearoa New Zealand.

Our job is to make your payroll seem like a breeze. We bundle all of your payroll services into one so that all you have to do is enter your employees’ time sheets into our system, then send us your employees’ gross payment, and the rest is taken care of.

Too good to be true, right? Not at all.

There’s a misconception that PAYE intermediaries can be costly, when in fact they save you valuable time AND money – by helping you stay compliant.

Did you know that failing to file an employment information form within 2 business days can result in fines from IRD? When you’re running around trying to keep your business afloat, it’s easy for information such as this to slip from your memory. A PAYE intermediary ensures there’s one less thing for you to think about so you can focus on growing your business and doing the things you love.

If these priorities sound like a good fit for your business, you’re in the right place. Thankyou Payroll has been navigating the complexities of payroll as a PAYE Intermediary for over 10 years now, sharing our expertise with thousands of small business owners in Aotearoa New Zealand.

Start your journey today, so you can focus on the reason you started your business in the first place.

Here’s Merissa, Thankyou Payroll’s Head of Product, with the low-down on PAYE Intermediaries and choosing a payroll provider that’s a good fit for your business.